What Does Kam Financial & Realty, Inc. Mean?

What Does Kam Financial & Realty, Inc. Mean?

Blog Article

Little Known Questions About Kam Financial & Realty, Inc..

Table of ContentsFascination About Kam Financial & Realty, Inc.Kam Financial & Realty, Inc. Fundamentals ExplainedAbout Kam Financial & Realty, Inc.The Kam Financial & Realty, Inc. DiariesKam Financial & Realty, Inc. Fundamentals ExplainedSome Known Incorrect Statements About Kam Financial & Realty, Inc.

When one thinks about that mortgage brokers are not required to submit SARs, the real volume of mortgage fraud activity might be much higher. (https://dzone.com/users/5250420/kamfnnclr1ty.html). Since early March 2007, the Federal Bureau of Examination (FBI) had 1,036 pending home loan fraudulence examinations,4 compared with 818 and 721, respectively, in both previous yearsThe bulk of home loan scams falls under 2 wide categories based upon the motivation behind the fraud. generally involves a borrower who will certainly overemphasize revenue or possession worths on his or her financial declaration to get a financing to purchase a home (mortgage broker in california). In several of these cases, assumptions are that if the revenue does not climb to satisfy the settlement, the home will certainly be cost a revenue from admiration

All About Kam Financial & Realty, Inc.

The huge bulk of scams circumstances are uncovered and reported by the establishments themselves. Broker-facilitated scams can be scams for building, fraudulence for profit, or a combination of both.

A $165 million community bank decided to get in the home mortgage financial service. The bank bought a tiny home loan business and hired a seasoned mortgage banker to run the procedure.

The Basic Principles Of Kam Financial & Realty, Inc.

The bank alerted its key federal regulator, which then called the FDIC as a result of the potential effect on the bank's monetary problem ((https://papaly.com/categories/share?id=18529d7232e542f1b27d23e4be44ed9b). More examination disclosed that the broker was functioning in collusion with a builder and an appraiser to turn homes over and over once more for greater, illegitimate profits. In total, greater than 100 loans were stemmed to one building contractor in the very same community

The broker declined to make the repayments, and the case entered into litigation. The bank was ultimately awarded $3.5 million. In a subsequent discussion with FDIC inspectors, the bank's head of state suggested that he had constantly heard that the most tough part of home mortgage banking was making certain you executed the ideal hedge to offset any interest rate risk the financial institution might sustain while warehousing a significant quantity of mortgage.

Kam Financial & Realty, Inc. for Dummies

The bank had depiction and guarantee clauses in contracts with its brokers and believed it had option with respect to the finances being originated and marketed via the pipe. Throughout the lawsuits, the third-party broker said that the financial institution should share some responsibility for this direct exposure since its inner control systems should have recognized a lending concentration to this community and instituted measures to deter this threat.

So, to obtain a far better hold on what the heck you're paying, why you're paying it, and for the length of time, let's damage down a regular month-to-month home loan payment. Don't be tricked right here. What we call a regular monthly home loan payment isn't just paying off your home mortgage. Instead, think about a regular monthly home loan payment as the 4 horsemen: Principal, Rate Of Interest, published here Real Estate Tax, and House owner's Insurance coverage (called PITIlike pity, because, you understand, it enhances your repayment).

Hang onif you assume principal is the only amount to take into consideration, you 'd be neglecting concerning principal's ideal pal: passion. It would certainly be wonderful to think loan providers let you obtain their money even if they like you. While that may be real, they're still running a service and intend to put food on the table as well.

What Does Kam Financial & Realty, Inc. Do?

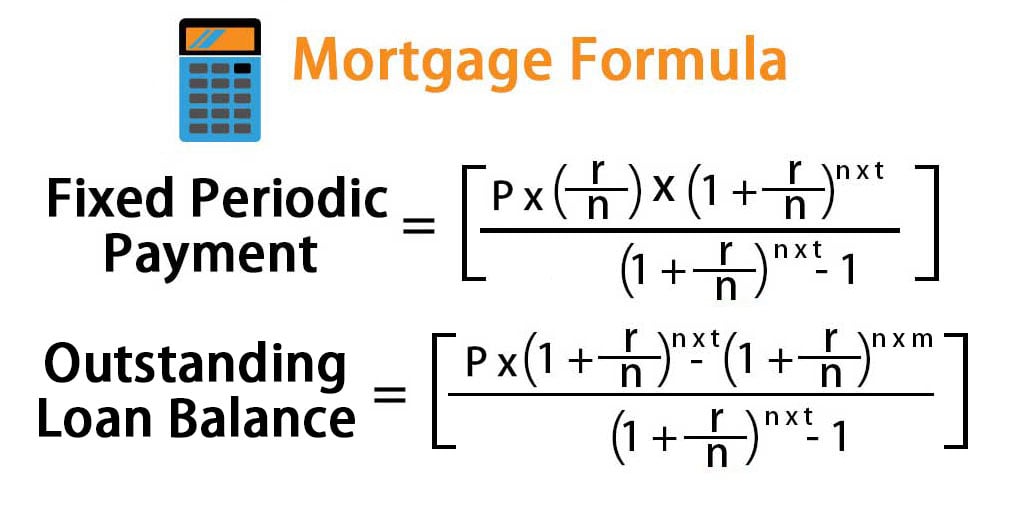

Interest is a percentage of the principalthe amount of the lending you have delegated settle. Rate of interest is a percent of the principalthe amount of the loan you have left to pay back. Home loan interest rates are continuously altering, which is why it's wise to pick a mortgage with a fixed rate of interest so you know how much you'll pay each month.

That would mean you would certainly pay a whopping $533 on your first month's home mortgage repayment. Obtain prepared for a little bit of math right here.

3 Simple Techniques For Kam Financial & Realty, Inc.

That would make your monthly home mortgage payment $1,184 monthly. Regular monthly Principal $1,184 $533 $651 The next month, you'll pay the same $1,184, yet much less will certainly go to rate of interest ($531) and more will certainly most likely to your principal ($653). That pattern proceeds over the life of your mortgage until, by the end of your home mortgage, almost all of your settlement approaches principal.

Report this page